Two Years of Mandatory Biodiversity Net Gain: What Has Changed and What Comes Next?

February marks two years since Biodiversity Net Gain (BNG) became mandatory for most developments in England. In that time, BNG has moved from policy reform to planning reality.

What began as a regulatory shift under the Environment Act is now embedded in development strategy, land management decisions, and Local Planning Authority processes across the country.

The first two years built the infrastructure. The next two will test its resilience.

From Policy to Practice: The Infrastructure Phase

When BNG became mandatory in February 2024, much of the focus was on system readiness. Key questions included:

Would there be enough off-site BNG units available?

Would LPAs interpret requirements consistently?

How would the DEFRA Biodiversity Metric operate in practice?

Would developers face delays in securing units?

Two years on, the infrastructure has largely taken shape. Across England, we have seen:

Rapid growth in registered habitat banks

Increased allocations recorded on the Natural England Register

Greater geographic coverage across LPAs and NCAs

Improved familiarity with biodiversity gain plans

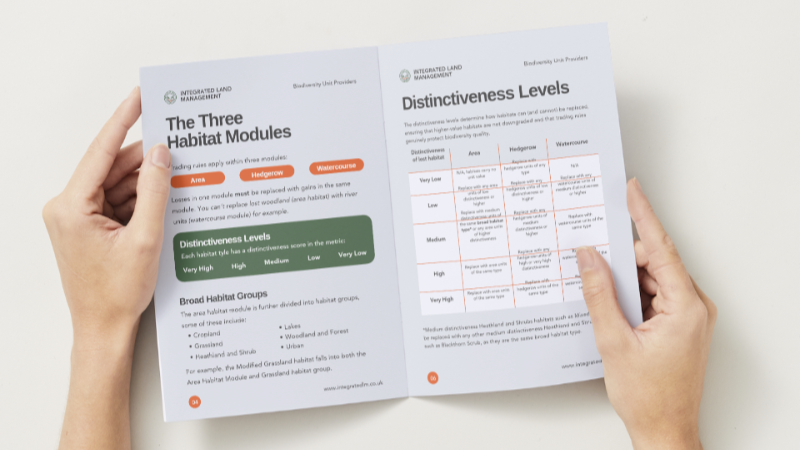

At Integrated Land Management, this evolution has been reflected in the growth of registered biodiversity gain sites across multiple regions, offering area, hedgerow and watercourse units at varying levels of distinctiveness.

For developers, attention has moved beyond compliance toward securing certainty in cost, timing and unit availability. For landowners, habitat creation for BNG has emerged as a structured, long-term diversification opportunity.

BNG Pricing and Market Behaviour

As supply has grown, the BNG unit market has entered a new phase: price discovery.

In more abundant habitat types, such as certain grasslands and hedgerows, pricing appears to be stabilising. This is a natural evolution in an emerging market:

More habitat banks entering the register

Increased competitive tension within some NCAs

Greater transparency around indicative pricing

More varied release strategies, including phased unit allocation

At the same time, scarcity remains in specific high distinctiveness and watercourse unit types. Not all habitats follow the same trajectory.

For example, Other Rivers and Streams, Wet Woodland and other higher distinctiveness habitats require longer-term ecological establishment and are not evenly distributed across regions. Sites such as Baldock, Bridge Farm, Dingley, and Monkton Habitat Banks illustrate how higher distinctiveness habitat creation is being brought forward with carefully structured design to align with local demand and delivery risk.

The result is a market that is becoming more nuanced and differentiated.

Geographic Coverage

One of the early concerns around Biodiversity Net Gain was local availability.

Two years on, most NCA's and LPA’s now have at least one in-area habitat bank. This is a significant milestone. It supports the core objective of BNG: securing ecological enhancement close to where development occurs.

However, availability does not always equate to choice. In some areas, the number of active suppliers remains limited. In others, increasing supplier presence is creating new competitive dynamics.

ILM’s registered habitat banks demonstrate how habitat composition and regional context influence procurement flexibility. The system is evolving - but not evenly across all regions or habitat types.

Prospect Hill Habitat Bank reflects how habitat delivery in the North East responds to different ecological character and planning pressures compared with sites in more densely developed regions.

Planning Confidence is Increasing

An important development over the past two years has been growing confidence across stakeholders.

BNG is becoming a routine component of planning, rather than an unfamiliar addition. This gradual normalisation is an important marker of maturity.

We are observing:

More consistent application of the mitigation hierarchy

Earlier integration of BNG into development appraisals

Increasing familiarity with the DEFRA Metric among ecologists and consultants

Greater clarity around discharge of BNG conditions

For developers seeking programme certainty, early-stage discussions around unit sourcing, spatial risk and habitat matching are now increasingly common.

Supply, Demand and Timing

Rapid growth in registered habitat banks has been one of the defining characteristics of the early BNG market. Looking ahead, attention is turning to demand dynamics. Development cycles are long. Allocations often occur later in the planning process when conditions are discharged.

This can create temporary timing gaps between supply entering the Natural England Register and units being allocated.

Over the coming years, several factors may shape the balance between supply and demand:

Continued habitat bank registrations

Strengthening preference for in-area mitigation

NSIPs the BNG regime in 2026

Greater sophistication in developer procurement stratgies

In higher development pressure regions, local alignment and habitat mix are increasingly important in securing allocations efficiently. Masketts Farm Habitat Bank provides an example of how proximity to development activity and careful habitat structuring influence both allocation patterns and procurement strategy.

As the market matures, strategic positioning of gain sites - including habitat composition, location and alignment with local demand - will become increasingly important for landowners considering participation.

The market is moving beyond its introductory stage.

The Next Two Years: Testing Resilience

The first two years built the infrastructure. The next two will test its resilience, which will depend on:

Consistent habitat delivery and long-term management

Clear pricing signals and responsible procurement

Collaboration between landowners, developers and planning authorities

Alignment between ecological objectives and commercial realities

Across ILM’s portfolio of biodiversity gain sites, long-term stewardship arrangements and monitoring frameworks form a central part of delivery - reinforcing that BNG is not simply a transactional mechanism, but a 30-year commitment to measurable uplift.

BNG has matured rapidly in a short period. The next phase is likely to be defined less by volume growth and more by quality of delivery, confidence in outcomes and strategic decision-making.

Conclusion: From Implementation to Refinement

Two years on, Biodiversity Net Gain is no longer an emerging concept - it’s a functioning regulatory framework and a developing environmental market.

For developers, the focus is shifting toward early-stage integration and programme certainty. For landowners, careful site selection, habitat mix and positioning within local markets are increasingly important.

The question is no longer “how does BNG work?”, it’s “how do we make it work well?”

If you would like to discuss how the evolving BNG market may affect your development strategy or landholding, our team would be pleased to arrange an early-stage conversation.